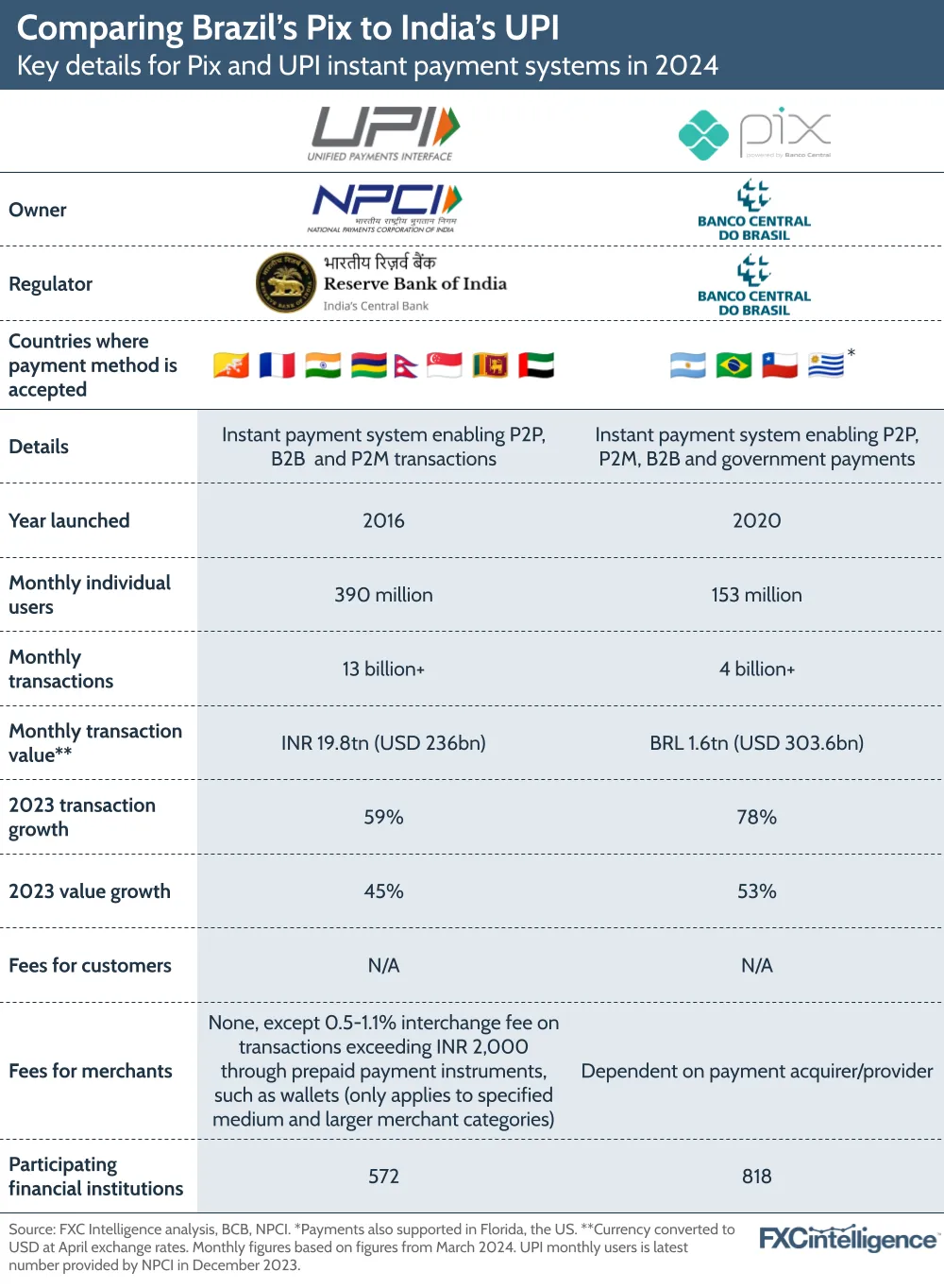

UPI, owned by India’s NPCI and regulated by the RBI, is decentralized, while Brazil’s Pix, owned and regulated by the Banco Central do Brasil, is centralized and widely adopted by financial institutions.

Both payment systems aim to enhance digital payment access and efficiency, reducing costs and intermediaries.

Pix has been rapidly adopted, reaching about 70% of Brazilians since 2020, while about 28% of Indians have used UPI since 2016. UPI has expanded internationally, unlike Pix, although Pix is making progress in regions including Uruguay and the US.

Source: FXCIntelligence 01 05 2024

Leave a Reply